OpenHouse Home Insurance provides a tech-enabled home insurance solution to help you get a policy for your home in minutes.

OpenHouse is administered by Frontline Insurance Managers, Inc. and underwritten by First Protective Insurance Company with headquarters in Lake Mary, Fla., serving homeowners for 25 years, protecting more than 300,000 homes and having paid more than $4 billion in claims.

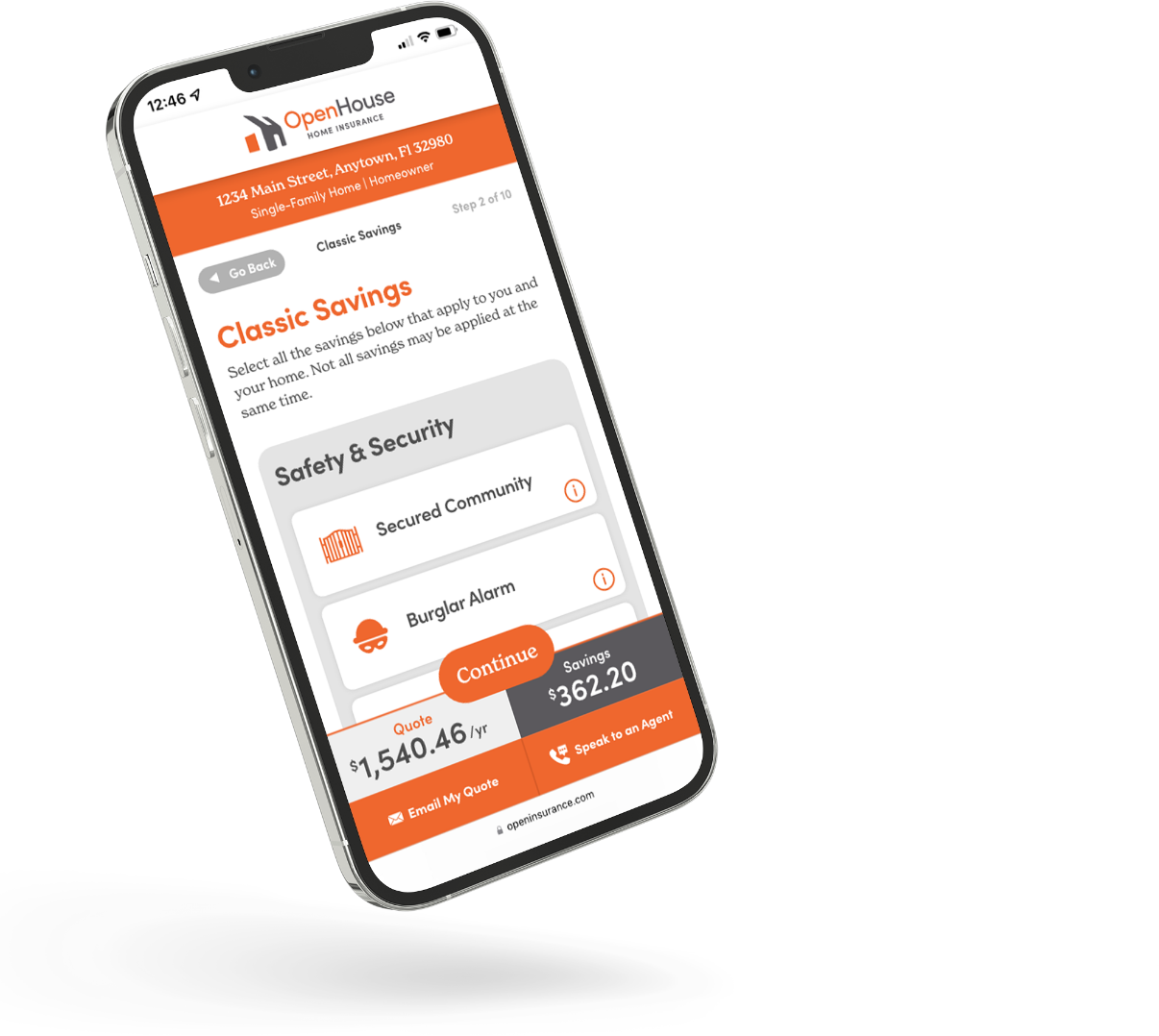

Throughout the OpenHouse digital experience, we guide you through home insurance plans that allow you to personalize the right coverage for you and your home.

This covers the cost to repair your home after a loss. The cost depends on factors like materials, style, and age. If you’re switching insurers, you might use the replacement cost on your current insurance as guidance. Keep in mind this is not the same as the market value or the purchase price of your home.

Tip: This coverage is generally referred to as Dwelling or Coverage A.

This covers your belongings, like your furniture, clothing, and electronics. Estimate how much it would cost to replace all your stuff in case of a fire or robbery—or, at the very least, the things you can’t live without.

Tip: This coverage is generally referred to as Personal Property or Coverage C.

This covers other structures on your property that aren’t your house, like a shed, fence, gazebo, or detached garage. If you’re switching insurers, you might use your previous coverage as guidance.

Tip: This coverage is generally referred to as Coverage B.

This covers you in the event you’re involved in an accident where someone is injured or their property is damaged, regardless of location. This coverage can help pay for any resulting legal fees, medical fees, or damage for which you are held responsible.

Tip: This coverage is affordable, even at the maximum amounts. This is coverage is generally referred to as Coverage E.

Unlike Personal Liability, Personal Injury is when you harm someone in a way outside of property damage or bodily injury. Instead, it covers cases like defamation, psychological damage, invasion of privacy, and abuse through social media.

Tip: This coverage is affordable at the maximum amounts.

If a guest is injured on your property, you may have to cover their medical costs. This coverage will help you proactively assist your injured guest.

Tip: This coverage is affordable at the maximum amounts. This coverage is generally referred to as Coverage F.

This covers the damage to your home and belongings if you experience sudden and accidental water damage, like a burst pipe or washing machine leak. It doesn’t include damage from a water backup, flooding from a rising body of water or hurricane, long-term leaks, or negligence.

This covers damage to your home, furniture, and other belongings if water backs up through your pipes or sewer system. Damage from a water backup won’t be covered unless you include this coverage, so it is highly recommended.

This covers you if you experience mold, fungus, or rot due to a covered loss (like a broken pipe or hurricane), and helps pay for testing, removal, and repairs. It includes your home, other structures, and belongings. The coverage is split into Property and Liability. Property is the maximum amount paid to you. Liability is the maximum amount that can be paid to a third party if someone is injured by your mold, fungus, or rot.

Sometimes when you need to rebuild or repair your home, you must meet new building codes and ordinances for things like electrical, plumbing, and safety. Meeting new codes is legally required, but can drive up your costs. This coverage helps pay for those extra costs.

Tip: Consider the age and value of your home. The older the home, the more likely it’s not up to the latest building code. This coverage is generally referred to as Ordinance or Law.

If your home is unlivable after a covered loss, this coverage helps take care of your necessary increase in living expenses. Think about finding a place to stay, dining out if you don’t have a kitchen, and even boarding your beloved pet while your home is rebuilt. Consider your standard of living and how long it could take to rebuild your home.

Tip: This coverage is generally referred to as Loss of Use or Coverage D.

This covers you in the case you have an animal that causes injury or damage. Some dog breeds and other animals have a greater likelihood of causing injury or damage and are excluded from this coverage. Consider the type of animal you have and their personality when selecting your coverage limit.

This coverage can help pay to repair or replace your screened enclosure if it’s damaged during a hurricane (after you pay the hurricane deductible). Screened enclosures are not included in your hurricane coverage unless you include this coverage. Tip: Select the amount of insurance you need to replace your enclosure if it is destroyed.

If you have jewelry, art, instruments, antiques, camera equipment, expensive collections, or any other extra valuable items, include them under this coverage instead of your Contents coverage estimate. With this, you can increase your coverage limits for each special item you add up to the standard maximums. Tip: This coverage is generally referred to as Scheduled Personal Property.

If you live within a homeowner’s association, you could share responsibility for property damage or liability costs within the community if the community’s insurance doesn’t cover it—even if it’s not your fault. For example, if an injury occurs because the community pool wasn’t maintained, all HOA members can be assessed to pay a proportional share of the resulting damages. If you’re part of an HOA, we strongly recommend this coverage. Tip: This coverage is generally referred to as Loss Assessment.

Typical auto and home insurance doesn’t include Golf Cart coverage. This coverage protects against damage, theft, fire, weather, bodily injury, pain and suffering, and property damage. If included, you can select the amount you want for physical damage, which should cover the cost to repair or replace your golf cart. Liability will be the same as your Personal Liability limit. Please note that golf carts licensed for the road are ineligible. This coverage is only available for carts that can carry up to 4 persons and are not designed or modified to exceed a speed of 25 miles per hour on level ground.

The answer is different for everyone because the cost to rebuild your home and belongings is unique. Replacement costs depend on factors like the size of your home, construction costs where you live, house materials, roof type, other property structures and more. When you start building your policy, we use your address and ask you questions to offer three quote options with recommended coverages. Once you pick the best option for you, you can further adjust your coverages as you please (we’ll offer advice along the way if you do).

You and residents of your household who are: (1) Your relatives; or (2) Other persons under the age of 21 and in your care or the care of a resident of your household who is your relative.

The annual cost of your OpenHouse Home Insurance policy. This will be determined by the coverages and deductibles you choose.

Hurricane: An OpenHouse Home Insurance policy covers losses to your property from a hurricane, but hurricane-related claims have their own deductible. This is the amount you pay before we can pay for a covered loss. You only pay the deductible once in a policy year, even if there are several hurricanes. With us, your hurricane deductible is 2% of your home rebuilding cost, but it’s also a Smart Deductible, so you get a growing amount of cash back every year you don’t have a non-hurricane claim.

Non-hurricane: This deductible applies to losses that are not related to hurricanes. It’s the amount you pay before we pay for a covered loss. It applies to all of your coverages unless otherwise specified. (Liability coverages don’t have a deductible.) Unlike the hurricane deductible, you pay for each claim you file. The options we have provided are standard. Tip: Consider how much you could afford to pay in an emergency. The higher the deductible, the lower your premium.

Our Home Insurance Glossary offers information on common terms found throughout our application process, and terms related to having an OpenHouse Home Insurance policy.

See the Glossary